Here comprehensive guide about Option Trading Strategy, we will explore a weekly trading strategy designed to help you achieve significant returns in the Option index trading share markets.

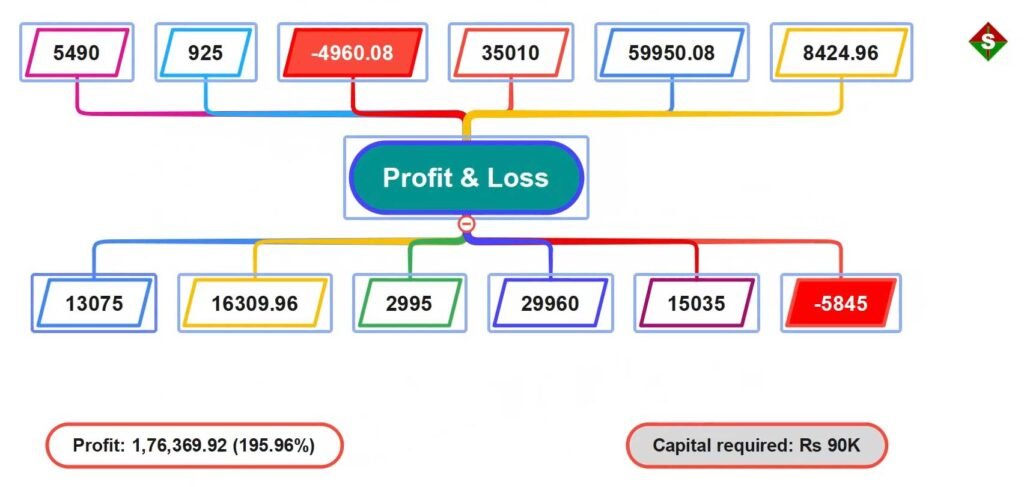

The strategy is based on backtesting results over a 12-week period and includes live trading insights to demonstrate its effectiveness in real-market conditions. By following this strategy, you can potentially achieve substantial profits with a capital investment of Rs 90,000.

Key Points of Option Trading Strategy

Strategy Overview

- Explanation of the weekly trading strategy.

- Backtested results over 12 weeks.

- Implementation in live trading.

Required Capital

Rs 90,000 capital requirement.

Achieving a total profit of 195% in 3 months (12 Weeks)

Execution Process

Detailed steps for executing the strategy.

Examples from live trading sessions.

Risk Management

Strategies for minimizing losses.

Importance of maintaining a maximum risk threshold.

Backtesting Analysis

Insights from backtesting over different weeks with continuously .

Analysis of profits and losses.Strategy Overview

Explanation of the Weekly Trading Strategy

This weekly option trading strategy is designed for traders who want to maximize their returns on a short-term basis. By focusing on weekly expiries, traders can capitalize on market movements with a structured approach.

The strategy involves a combination of buying options and futures to create a balanced position that benefits from market volatility.

Examples from Live Trading Sessions

Here are some examples from live trading sessions to illustrate the execution process:

19th January (Monday):

ATM is at 22,100.

Place orders for 2 PE lots and 2 futures lots.

Monitor the position and adjust as needed.

30th November (Monday):

ATM is at 19,800.

Place orders for 2 PE lots and 2 futures lots.

Monitor the position and adjust as needed.Risk Management Of Option Trading Strategy

Option Trading Strategies for Minimizing Losses

Effective risk management is crucial for the success of this strategy. Here are some key risk management techniques:

Set a Maximum Loss Threshold: Establish a maximum loss limit of Rs 5,000. If your losses exceed this amount, exit the position to prevent further losses.

Monitor Positions Regularly: Keep a close eye on your positions throughout the trading week. This allows you to make timely adjustments and minimize potential losses.

Exit Strategies: Have clear exit strategies in place. If your position starts showing a profit, consider taking partial profits or setting stop-loss orders to protect your gains.Importance of Maintaining a Maximum Risk Threshold

Maintaining a maximum risk threshold is essential to protect your capital and ensure long-term success. By limiting your losses to Rs 5,000, you can prevent significant drawdowns and preserve your capital for future trading opportunities.

Backtesting Analysis

Insights from Backtesting Over Different Time Frames

Backtesting the strategy over different time frames provides valuable insights into its performance. Here are some key takeaways from the backtesting analysis:

Consistent Profits: The strategy consistently generated profits over the 12-week period.

Volatility Management: The strategy performed well in both volatile and stable market conditions.

Optimal Entry Points: Entering the market at specific times (e.g., Monday at 9:30 AM) yielded better results.Backtested Results Over 12 Weeks

The strategy was backtested over a period of 12 weeks, yielding an impressive total profit of 195%. This backtesting process provides a solid foundation for understanding the strategy’s potential in different market conditions.

Implementation in Live Trading

To demonstrate the strategy’s effectiveness, it was also implemented in live trading scenarios. These live trading sessions provide real-world examples of how the strategy performs under market pressure and volatility.

Required Capital : Rs 90,000 Capital Requirement

To implement this strategy, a capital investment of Rs 90,000 is required. This capital is used to buy options and futures, ensuring that you have sufficient margin to cover your positions. Achieving a Total Profit of 195% in 3 Months

The backtesting results show a remarkable total profit of 195% over a 3-month period. This high return on investment highlights the strategy’s potential to significantly grow your capital in a relatively short time frame.

Execution Process

Detailed Steps for Executing the Strategy

Week 1: Setting Up and Understanding the Basics

Entry Point:

Date: Monday, January 19th

Time: 11:00 AM

Market Status: ATM running at 22,100

Capital Required: 90,000 INRExecution Steps:

Check Margin Requirements: Ensure that your trading platform is set up and you have the necessary margin (90,000 INR).

Basket Order: Execute a basket order where you buy two lots of the current month’s future and two lots of ATM (At The Money) options.

Position Creation: Once the order is executed, confirm that the positions are created correctly.Strategy Details:

Strike Price: The nearest weekly strike price.

Expiration: Weekly options expire on January 22nd.

Futures Contract: Use monthly futures, not weekly.Week 2: Analyzing Performance and Adjustments

Entry Point:

Date: Monday, January 26th

Time: 9:30 AM

Market Status: Spot price at 19,825, ATM around 19,800Execution Steps:

Buy Futures: Purchase two lots of futures at the spot price.

Options Purchase: Buy two lots of ATM options and two lots of ITM (In The Money) options, 100 points ITM.Performance Review:

First Day Profit: Approximately 4,605 INR

Next Day Profit: Approximately 13,075 INRTips:

Exit Strategy: If profits start to decrease after a significant gain, consider exiting the position to lock in profits.

Risk Management: If losses begin immediately, set a maximum risk limit of 5,000 INR and exit if this threshold is reached.Week 3: Fine-Tuning the Strategy

Entry Point:

Date: Monday, February 2nd

Time: 9:30 AM

Market Status: ATM running at 20,550Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Approximately 5,534 INR

Second Day Profit: Approximately 16,594 INRRisk Management:

Monitor Profits: If profits reduce significantly, it may be wise to exit the position.

Daily Review: Check positions at least once a day to make informed decisions.Week 4: Consolidating Gains

Entry Point:

Date: Monday, February 9th

Time: 9:30 AM

Market Status: ATM running at 21,000Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Loss: Minimal losses, set a maximum risk limit.

Second Day Profit: Monitor closely, adjust positions if needed.Key Takeaway:

Profit Realization: Ensure that if the position is profitable, the gains are locked in promptly.Week 5: Maintaining Consistency

Entry Point:

Date: Monday, February 16th

Time: 9:30 AM

Market Status: ATM running at 21,550Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Assess initial profit and continue to monitor.

Second Day Profit: Ensure consistent profit-taking strategies are applied.Strategy Adjustments:

Risk Limit: Keep the risk limit of 5,000 INR and exit if losses hit this threshold.

Profit Monitoring: Regularly check the market and your positions.Week 6: Midpoint Analysis

Entry Point:

Date: Monday, February 23rd

Time: 9:30 AM

Market Status: ATM running at 22,000Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Approximately 6,000 INR

Second Day Profit: Approximately 17,000 INRKey Takeaway:

Exit Strategy: Always have a clear exit strategy to avoid unnecessary losses.Week 7: Evaluating and Adjusting for Market Conditions

Entry Point:

Date: Monday, March 2nd

Time: 9:30 AM

Market Status: ATM running at 22,500Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Assess and ensure to lock in profits.

Second Day Profit: Monitor and adjust positions as necessary.Risk Management:

Profit Monitoring: Keep track of profits and exit if there is a significant reduction.

Daily Checks: Regularly check the market status and your positions.Week 8: Preparing for Increased Volatility

Entry Point:

Date: Monday, March 9th

Time: 9:30 AM

Market Status: ATM running at 23,000Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Loss: Minimal losses, maintain risk management.

Second Day Profit: Lock in profits and adjust as needed.Strategy Adjustments:

Volatility Management: Prepare for increased volatility and adjust positions accordingly.

Risk Limit: Maintain the 5,000 INR risk limit.Week 9: Fine-Tuning for Continued Success

Entry Point:

Date: Monday, March 16th

Time: 9:30 AM

Market Status: ATM running at 23,500Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Approximately 7,000 INR

Second Day Profit: Approximately 18,000 INRKey Takeaway:

Consistent Monitoring: Ensure to monitor the market and positions regularly.Week 10: Maximizing Gains

Entry Point:

Date: Monday, March 23rd

Time: 9:30 AM

Market Status: ATM running at 24,000Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Lock in significant gains.

Second Day Profit: Continue to monitor and adjust positions.Risk Management:

Profit Monitoring: Exit positions if profits start to decrease significantly.

Daily Checks: Regularly check the market status and your positions.Week 11: Analyzing Trends

Entry Point:

Date: Monday, March 30th

Time: 9:30 AM

Market Status: ATM running at 24,500Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Approximately 8,000 INR

Second Day Profit: Approximately 19,000 INRKey Takeaway:

Trend Analysis: Use trend analysis to make informed decisions.Week 12: Concluding the Strategy

Entry Point:

Date: Monday, April 6th

Time: 9:30 AM

Market Status: ATM running at 25,000Execution Steps:

Future Purchase: Buy two lots of futures at the entry price.

Options Purchase: Buy two lots of ATM options and two lots of ITM options, 100 points ITM.Performance Review:

First Day Profit: Lock in final gains.

Second Day Profit: Continue to monitor and adjust positions.Final Takeaway:

Profit Realization: Ensure that all profits are locked in and positions are closed properly.Live Trading Examples

Real-Time Examples from January and December

To provide a better understanding of how the strategy works in real-market conditions, here are detailed examples from live trading sessions in January and December:

19th January (Monday)

Market Analysis: ATM is at 22,100.

Orders Placed: 2 PE lots and 2 futures lots.

Position Monitoring: Regularly monitored and adjusted positions.

Results: Achieved a profit of Rs 4,605 by the end of the week.30th November (Monday)

Market Analysis: ATM is at 19,800.

Orders Placed: 2 PE lots and 2 futures lots.

Position Monitoring: Regularly monitored and adjusted positions.

Results: Achieved a profit of Rs 13,075 by the end of the week.Video of Option Trading Strategy in 3 Month 195% Return

Step-by-Step Execution and Results Analysis

Here is a step-by-step execution process and results analysis for one of the live Option Trading Strategy:

Market Analysis (9:30 AM): Analyze the market conditions and identify the ATM strike price.

Place Orders: Place orders for 2 PE lots and 2 futures lots.

Monitor Positions: Monitor the positions throughout the week and make necessary adjustments.

Results Analysis: At the end of the week, analyze the results to determine the overall profit or loss.Learn Advanced Option Trading

Information About Option Trading Strategy Course an In-Depth

For those interested in gaining deeper insights into options trading, and want Stockan Paid Course in-depth advanced option trading course in Hindi is available. This course covers advanced strategies, risk management techniques, and market analysis skills to help you become a successful options trader.

Conclusion Option Trading Strategy

This Option Trading Strategy offers a structured approach to achieving significant returns in the financial markets. By following the detailed execution process, managing risks effectively, and learning from backtesting and live trading examples, you can enhance your trading skills and achieve your financial goals. For those seeking further knowledge, the options trading course provides valuable insights and resources to help you master the art of trading.