If you’re looking for a consistent, high-probability Weekly Options Trading Strategy – 3 Years of Results that has stood the test of time, you’re in the right place. In this article, we’ll dive deep into a weekly options strategy that has delivered outstanding results over the past three years, from 2021 to 2024.

The Option Strategy Explained Below

The strategy revolves around trading Bank Nifty options using a four-strike price combination approach.

Here’s how it works:

Choose an At-The-Money (ATM) strike price for Bank Nifty options.

On the Put side:

- Buy 1 lot of Put options 500 points Out-of-The-Money (OTM) from the ATM strike.

- Sell 2 lots of Put options 600 points OTM from the ATM strike.

On the Call side:

- Buy 1 lot of Call options 500 points OTM from the ATM strike.

- Sell 2 lots of Call options 600 points OTM from the ATM strike.

For example, if the Bank Nifty ATM strike is 48,800, you would:

Put Side:

- Buy 1 lot of 48,300 Put options (500 points OTM)

- Sell 2 lots of 48,200 Put options (600 points OTM)

Call Side:

- Buy 1 lot of 49,300 Call options (500 points OTM)

- Sell 2 lots of 49,400 Call options (600 points OTM)

This four-strike price combination creates a risk-defined spread trade with limited profit potential but also limited risk exposure.

The Execution Plan:

The strategy is implemented on a weekly basis, with positions being entered on Friday mornings around 9:25 AM and exited before market close at around 3:20 PM on the same day.

The margin requirement for this strategy is approximately ₹1,40,000 per lot traded in Bank Nifty options.

Backtest Results: 2021 – 2024

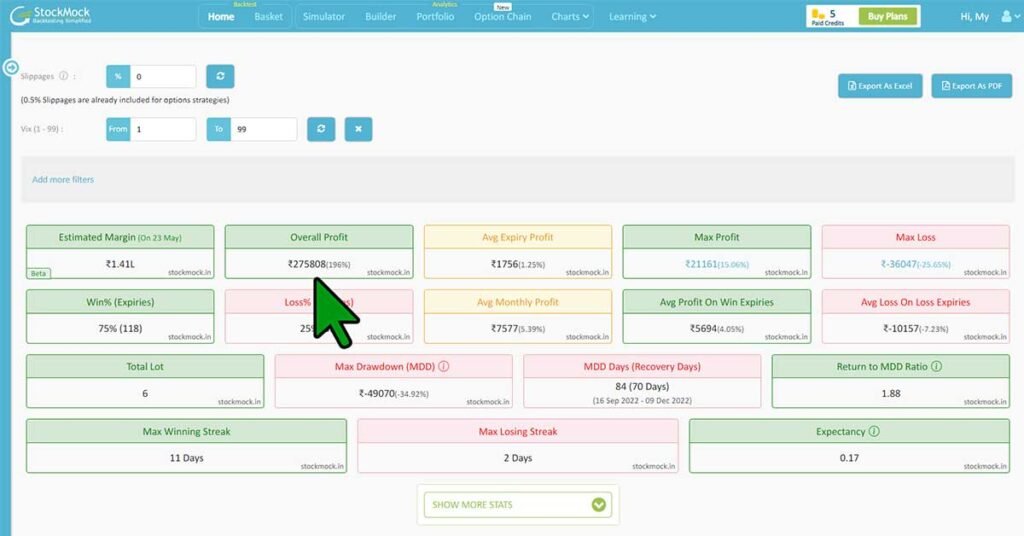

The true power of this strategy lies in its consistent performance over an extended period. Let’s look at the backtest results from 2021 to 2024 (data as of May 24, 2021):

- Overall Return: Approximately 200% return on the initial margin deployed.

- Winning Percentage: A staggering 75% of the weeks were profitable trades.

- Number of Winning Weeks: 118 weeks.

- Number of Losing Weeks: 39 weeks.

These results are nothing short of impressive, especially considering the strategy’s high win rate and the extended three-year period over which it was tested.

The Importance of In-Depth Knowledge:

While the strategy may seem straightforward, it’s crucial to understand that successful options trading requires in-depth knowledge and market understanding. There are numerous factors to consider, such as adjustments to the strategy, risk management techniques, and the ability to adapt to changing market conditions.

That’s why, with a 100% money-back guarantee, you can join stockan advanced options trading course to gain comprehensive knowledge and become a proficient options trader. Our course covers advanced concepts, risk management strategies, and real-world examples to help you implement this strategy and others effectively. Here Stockan Paid Course

Why This weekly Option Strategy Works?

There are several reasons why this weekly options strategy has been so successful:

- Big range Trades: By using a four-strike price combination, the strategy comes with big range.

- High Probability Setups: The strategy takes advantage of the inherent volatility in the options market, setting up high-probability trades with favorable risk-reward ratios.

- Weekly Time-frame: Trading on a weekly basis allows the strategy to capture short-term market movements while avoiding the noise and increased risk associated with Intraday trading.

- Diversification: By trading both Put and Call options simultaneously, the strategy diversifies risk and increases the chances of profiting from market movements in either direction.

- Consistent Execution: The strategy’s consistent entry and exit times, along with its well-defined rules, eliminate emotional decision-making and ensure disciplined trade.

Notes: Before Ahead and taking any action

While past performance is no guarantee of future results, the consistency of this strategy over a three-year period is highly encouraging. However, it’s important to note that losses are an inherent part of any trading strategy, and risk management is crucial.

By continuously analyzing the strategy’s performance, making necessary adjustments, and incorporating advanced techniques, it’s possible to further enhance its profitability. Additionally, combining this strategy with other complementary approaches can potentially lead to even better overall results.

Conclusion about this option trading strategy

The weekly options trading strategy outlined in this article has proven its mettle, delivering remarkable results over a three-year period from 2021 to 2024. With a 75% winning percentage and a 200% return on initial margin, it offers a compelling opportunity for traders seeking consistent profits.

However, it’s essential to remember that successful options trading requires in-depth knowledge, disciplined execution, and effective risk management. By joining our advanced options trading course, you’ll gain the skills and expertise necessary to implement this strategy and others effectively, while also benefiting from a 100% money-back guarantee.

Whether you’re a seasoned trader or just starting, this strategy presents a unique opportunity to capitalize on the options market’s volatility while maintaining a defined risk profile. So, why not take the first step towards consistent profitability and join us on this exciting trading journey?