Trading in options can be highly profitable if approached with the right strategies. Today, I will share a Stockan Paid Course Options Buying Strategy for Monthly that can be applied to various indices like Nifty, Bank Nifty, and Fin Nifty.

If you follow this strategy, you might not need any other options buying methods. I have been consistently testing this strategy for several months and will explain it in detail with results.

Understand the concept of this buying strategy of Stockan course

Many traders employ different methods to trade options, but the key to profiting in options trading is not just doing something different but doing something better. This strategy is relatively simple yet effective for those who believe markets either go up or down.

The Core of this Options Buying Strategy for Monthly

The basic idea here is to buy both Call (CE) and Put (PE) options simultaneously. Markets will move in one direction or another, and our aim is to profit from that movement. Here’s a step-by-step breakdown of the strategy:

Entry Timing and Selection:

- Enter the market on the first Monday of the month.

- Choose strike prices where there is maximum liquidity, preferably near-the-money (ATM).

Initial Setup:

- Buy an equal number of Call and Put options.

- For example, if you expect the market to drop, buy a PE. Conversely, if you expect the market to rise, buy a CE.

- Ensure that the strike prices are close to each other and that there is enough liquidity to facilitate easy entry and exit.

Managing the Positions:

- Monitor your positions daily.

- Book profits in the profitable leg (either CE or PE) as the market moves.

- Adjust the losing leg to minimize losses. This could mean rolling over to a different strike price or expiry date.

Detailed Explanation and Adjustments

Let’s delve into more specifics using an example. Assume the market is at 18,000:

Initial Entry:

- Buy 1 CE at 18,000 (ATM) and 1 PE at 18,000 (ATM).

- Ensure that the premiums of both options are similar to keep the cost balanced.

Daily Monitoring:

- Check the positions at the end of each day.

- If the market moves significantly up or down, book profits in the winning leg.

- Adjust the losing leg by either buying additional options at a more favorable strike price or selling off to cut losses.

Real-Life Scenario

For instance, if on a particular day the market moves to 18,200, your CE would likely be in profit while your PE would be at a loss. In this case, you could:

Book Profits:

- Sell the profitable CE.

- Keep the PE and adjust its position if necessary by rolling over to a different strike price.

Adjustment:

- If the PE is showing significant loss, consider buying a new PE at a higher strike price (e.g., 18,200).

- Alternatively, you can sell off the losing PE and reposition into a new CE or PE depending on market conditions.

Example Calculation

Let’s say you bought the CE and PE for ₹100 each. If the market moves and the CE is now worth ₹150, you can:

- Sell the CE for ₹150, realizing a profit of ₹50.

- Hold or adjust the PE, which might be worth ₹50 now, resulting in a loss of ₹50.

The net result would be breakeven. However, by continuously monitoring and adjusting, you can optimize the overall profits.

Stockan Video On this Index option Buying Strategy

Practical information about this buying option strategy of Stockan course

1. Liquidity is Key:

- Always enter positions where there is high liquidity to avoid slippage and ensure smooth entry and exit.

2. Avoid Deep OTM and ITM Options:

- Stick to ATM or slightly OTM/ITM options for better liquidity and manageable premiums.

3. Regular Adjustments:

- Adjust positions regularly to lock in profits and manage losses. This might involve rolling over to new strike prices or expiry dates.

4. Transaction Costs:

- Consider brokerage and other transaction costs. For example, if your brokerage charges ₹20 per trade, factor this into your calculations to ensure net profitability.

More Stockan Paid Course | Option Trading Strategy with Result

Monthly Execution Plan

A. First Week Execution:

- On the first Monday of the month, enter the market with equal CE and PE positions.

- Monitor and adjust daily based on market movements.

B. Mid-Month Adjustments:

- Around the mid-month mark, reassess your positions. If one leg is significantly profitable, consider exiting and repositioning.

C. End of Month:

- As expiry approaches, ensure all positions are closed or rolled over to the next month to avoid expiry risks.

Example Backtest

To illustrate, let’s backtest the strategy with historical data. Assume:

- Initial Market Position: Nifty at 18,000

- Entry: Buy 1 CE and 1 PE at 18,000

- Daily Monitoring: Track the market movements and adjust positions.

If, on the first day, the market rises to 18,200:

- CE Position: Worth ₹150 (profit of ₹50)

- PE Position: Worth ₹50 (loss of ₹50)

- Net Result: Breakeven

Continuing this process, the aim is to consistently book profits in the winning leg and adjust the losing leg to minimize overall losses.

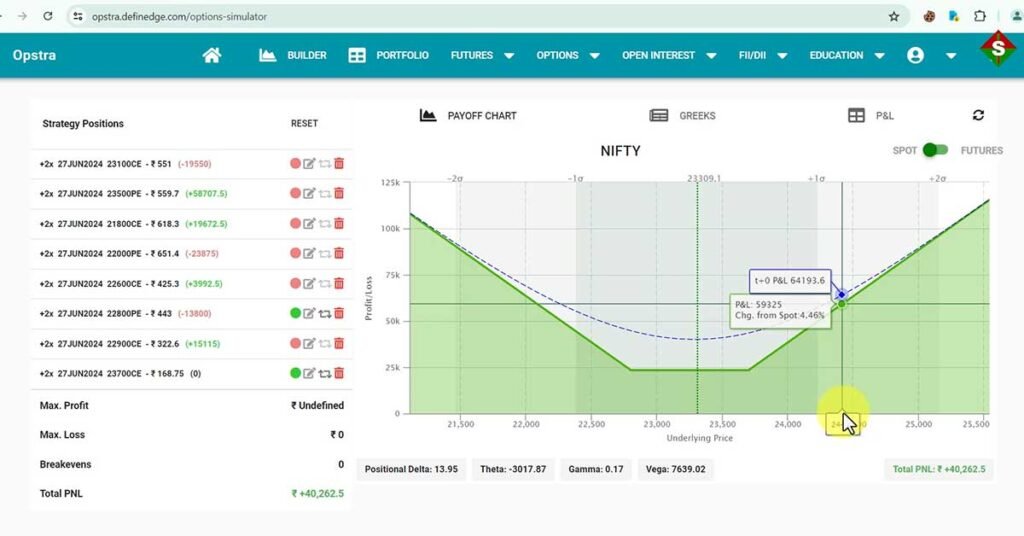

Graphical Representation and Loss Minimization

By continuously adjusting your positions, you can reach a point where your losses are minimized to zero. The graphical representation of this strategy often shows a break-even or profit scenario, indicating that with proper adjustments, it’s possible to avoid losses altogether.

When monitoring your positions, if you find both CE and PE in loss, exit both positions and re-enter new ones based on the current market conditions. The goal is to ensure that at least one leg remains profitable, covering any potential losses from the other leg.

Conclusion of this buying strategy of Stockan Paid course

This monthly options buying strategy hinges on the core principles of liquidity, timely adjustments, and consistent monitoring. By following the steps outlined and remaining disciplined in execution, you can optimize profits and manage risks effectively. Always remember to factor in transaction costs and avoid deep OTM/ITM options to ensure a balanced and liquid trading strategy.

For more in-depth insights and advanced strategies, consider enrolling in specialized options trading courses that cover a range of techniques from monthly, weekly to intraday trading. These courses provide detailed explanations, backtesting methods, and real-life examples to help you become a proficient options trader.

Additional Insights:

The video also emphasizes the importance of maintaining a zero-loss strategy through continuous adjustments. By frequently monitoring and re-adjusting your positions, you can avoid significant losses. Here are some additional tips from the video:

1. Graph Analysis:

Regularly check the profit/loss graph to ensure that your strategy is on track.

The graph should ideally show zero loss with potential for profit through strategic adjustments.

2. Handling Losses:

If both CE and PE positions are in loss, don’t hesitate to exit and re-enter at more favorable strike prices.

The strategy ensures that losses are minimized and profits are maximized through continuous repositioning.

3. Real-Life Example:

If, for example, both positions are in loss by mid-month, exit both and re-enter at new strike prices based on the current market scenario.

The goal is to always stay ahead by repositioning into potential profit zones.

Conclusion

Combining these additional insights with the core strategy enhances your ability to trade options profitably on a monthly basis. The key is to remain disciplined, monitor the market regularly, and make necessary adjustments without hesitation. By doing so, you can maintain a zero-loss strategy and consistently achieve profitable results.

For those interested in a more comprehensive understanding and advanced techniques, consider exploring specialized courses that provide detailed methodologies and real-life trading examples. Stockan Paid Course

🚫 DISCLAIMER

This video is for educational purposes only and does not constitute any financial or investment advice.

I am not a SEBI-registered investment advisor. All views shared in this video are for learning and informational purposes only.

Trading in the stock market, especially options trading, involves high risk and may lead to loss of capital. Past performance is not indicative of future results.

Please do your own research and consult a SEBI-registered financial advisor before making any investment or trading decision.

The Stockan channel will not be responsible for any profit or loss arising from actions taken based on this video.